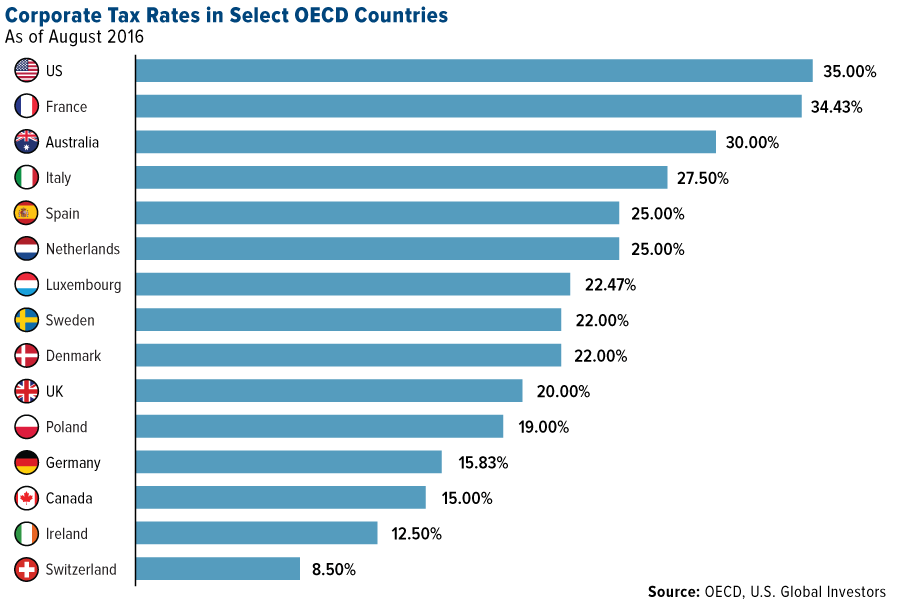

Tax Foundation on Twitter: "Whether we use corporate tax collections as a portion of GDP, average effective tax rates, or marginal tax rates, each measure shows that the U.S. effective corporate tax

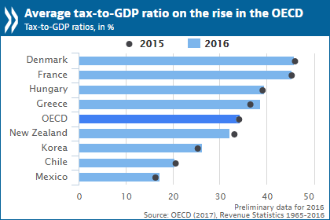

Social security contributions and consumption taxes give way to personal income taxes, as corporate income taxes fail to recover - OECD

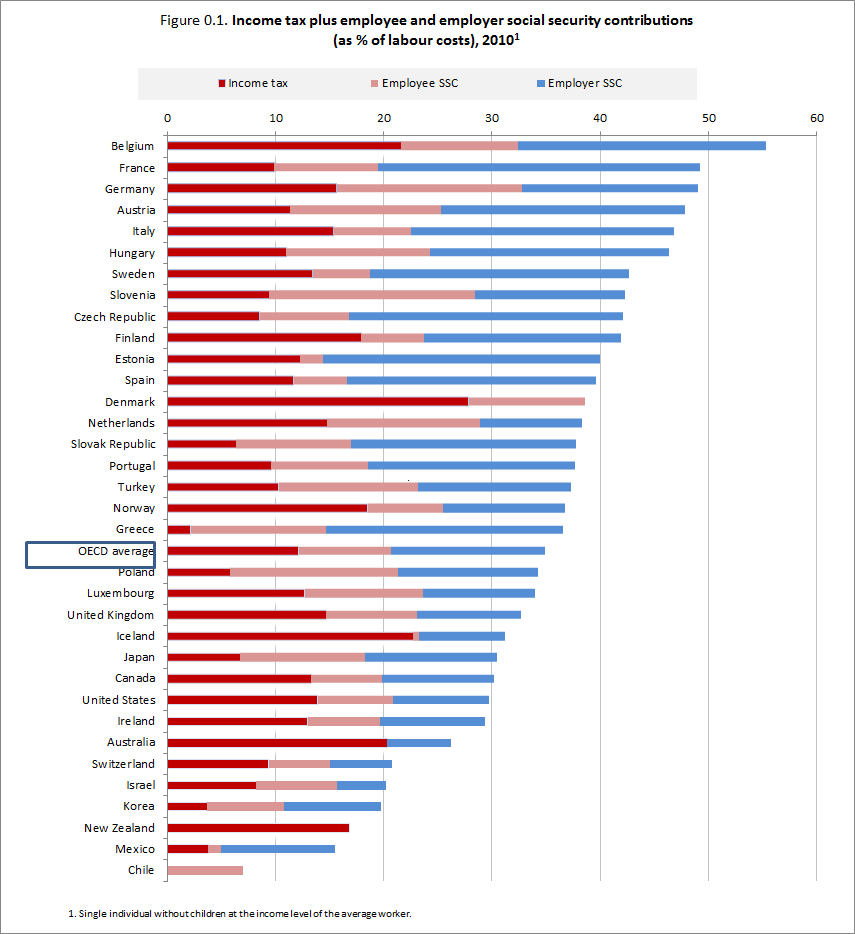

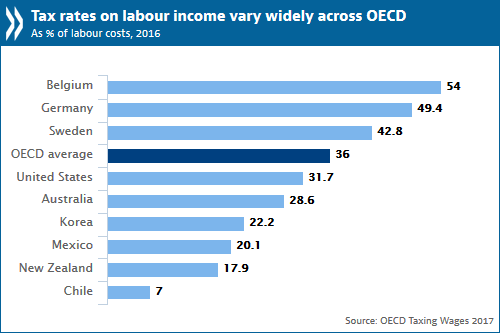

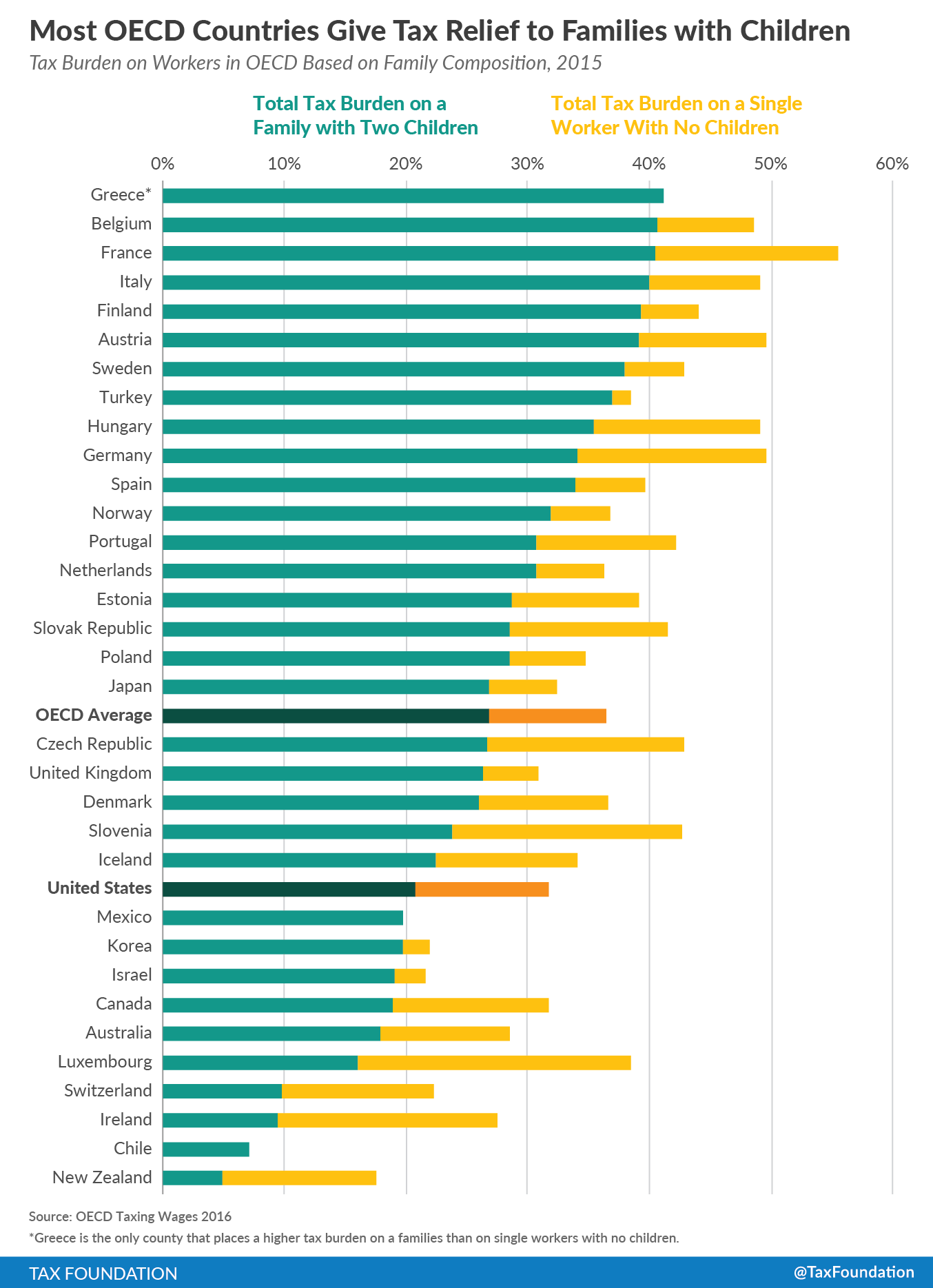

OECD - The net personal average tax rate varies widely across OECD countries: >35% in Belgium, Denmark & Germany <15% in Chile, Korea & Mexico Compare your country, then see http://bit.ly/2vN9mIA #TaxingWages